Table of Content

- Do I Qualify For A Navy Debt Consolidation Loan?

- What Does The Scra Do?

- Use Your Financial Savings Deposit Program (sdp)

- Debt And Security Clearance

- #7: The Mdcl Will Increase Your Monthly Payments

- Tip No 8: Consider A Lump-sum Debt Cost With Your Sdp

- This Free Download Is The One Guide To Getting Out Of Debt

That means you're refinancing your present loan for more than the quantity owed and taking the difference in cash. There are closing costs involved, which get subtracted from the final amount you receive. Still, the youth and financial inexperience of many members of the armed companies — particularly enlisted personnel — make dealing with debt a regrettable part of the expertise. While many households can comfortably pay off their debt, it is clear that many people are fighting debt.

If you apply and don't settle for any particular mortgage provide, merely decline the mortgage provide with no credit score risk. This unsecured mortgage requires no collateral, has no unnecessary fees, and will not shock you with any hidden charges. Click right here for extra details about debt consolidation hardship packages for military personnel. As someone who has served the United States of America with honor and distinction, you shouldn’t be saddled with debt, whether or not you’re still within the service or are now retired.

Do I Qualify For A Navy Debt Consolidation Loan?

Is there a special private debt consolidation mortgage for military personnel and veterans? While it's attainable that you have got seen banks or lenders advertise such a product, the government does not have any special program for private debt consolidation loans. Like civilians, veterans and active obligation personnel can negotiate their privately-held loans such as bank card debt. This is often accomplished with the assistance of a good debt settlement firm, though there is a severe draw back to your credit score rating for selecting this method. Look for numerous debt repayment solutions, similar to debt consolidation, debt management, and veteran debt reduction programs.

It is essential to do your homework and not rush into any program that sounds too good to be true. Providing protection to a service member who obtained a mortgage after getting into lively obligation, however who isn't available to defend him or herself towards judicial proceedings. When not on the golf course, he could be found traveling with his spouse or spending time with their eight wonderful grandchildren and two cats. Explore VA Health Care Benefits– Explore VA supplies a fast way to learn about VA advantages, find out which ones you could be eligible for, share information with friends and family, and apply for advantages. Chapter 7, or “straight” chapter, presents protection from creditors and assortment agents, nevertheless it comes at a price.

What Does The Scra Do?

In short, the VA guarantees a portion of the loan, which is likely certainly one of the causes lenders are willing to offer these loans. The Homeowners Assistance Program offers financial aid to certified candidates who have to sell their home at a loss or usually are not in a place to sell their residence. The benefit program is out there to active-duty personnel and veterans, civilian staff of the Department of Defense, and surviving spouses. Beware of predatory lenders utilizing patriotic symbols of their promoting that promise loans for service members. If you undergo from monetary misery as a result of an unplanned occasion, contact the suitable reduction society in your service branch and ask about a grant or loan for your specific want.

Does the amount of debt you carry have you ever facing an uphill climb, the likes of which you haven’t seen since boot camp? As an active-duty service member within the armed forces — or somebody who's career-retired — Omni Financial is prepared and keen to share the load so you might get back on a much flatter highway. With a military debt consolidation loan, we may help you get your finances underneath management so they’re no longer weighing you down and get your credit rating to larger floor.

Use Your Savings Deposit Program (sdp)

The advantage of a MDCL is that you usually pay a lower interest rate and shutting costs than civilians and much less curiosity than you'll using bank cards. Theserefinancing loanscan be spread out over 10, 15 and typically even 30 years, providing you with a wide-range of compensation selections. The minimal monthly payments aren’t sufficient for a veteran drowning in debt. This repayment schedule will take years and possibly result in thousands of dollars in curiosity prices. Too usually, these loans have excessive interest rates, which implies that a good portion of your payment goes to interest. Finding the right debt consolidation or debt aid program is the primary step to monetary freedom.

The VA house mortgage program normally looks at solely the earlier 12 months of credit historical past unlessbankruptcies, tax liens or collections are involved. It additionally doesn’t require a down fee, and rates of interest are typically decrease than these provided with standard loans. Military service members can also get a loan by refinancing their home through the VA. Qualified veterans can use the Interest Rate Reduction Refinancing Loan to acquire a decrease interest rate or change from a variable fee mortgage to a hard and fast price. If you need to take cash out of your personal home equity, the Cash-Out Refinance Home Loans packages lets you exchange your present loan with one which has new phrases.

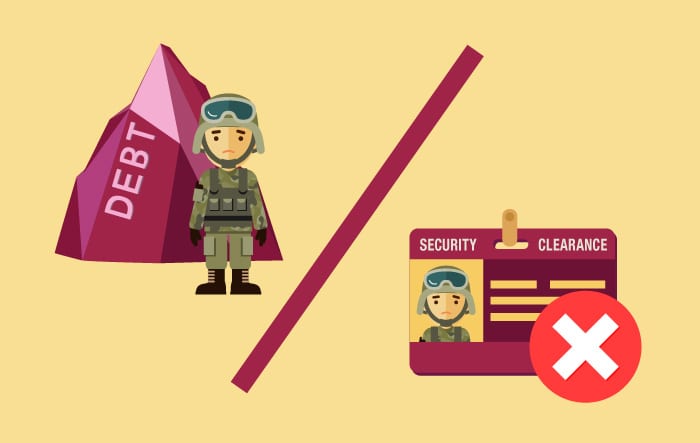

Debt And Safety Clearance

Members of the navy have lots to fret about when they are serving our nation. The final thing they should have to fret about is if they paid the mortgage and credit card bills this month. All Fees are waived together with our monthly maintenance charge with proof of being Active Duty Military. That means completely zero cost to lively responsibility members of our military.

In addition, there are well being and life insurance coverage advantages, housing benefits and tax deductions for school students who're army spouses. Veterans and active military wrestle with mortgages, auto loans and credit card debt the same as civilian consumers. Bills can pile up whereas you’re deployed or if you’re a vet and simply lost a job. USAA provides personal loans with rates of interest ranging from 6.69% to 18.51%. These loans can be used to consolidate bank card debt, however they aren't marketed as debt consolidation loans.

They supply mortgage amounts between $2,500 and $20,000, with interest rates based mostly on the credit score of the applicant. Like traditional lenders, their average rate of interest on a personal mortgage is slightly lower than 10%. According to data gathered by Urban.org from a sample of credit score stories, about 26% of people in the US have some sort of debt in collections.

By clicking “Submit” I consent to receive calls and e mail message offers/information from Debt Reduction Services, Inc. using an autodialer/pre-recorded message at the quantity I provided. I perceive that msg/data rates might apply and that my consent to such communications isn't a requirement for purchase. If you wish to stop receiving textual content messages from DRS, simply reply to a obtained text with the word STOP. At Debt Reduction Services, our aim is to offer training, info, and companies that can assist you find the best resolution for handling your debts. If you may be in a hardship, then think about different debt consolidation packages. From PCS and housing options to schooling and retirement advantages, we have your finances lined.

It doesn’t matter if you want cash for an enormous buy or you’re taking a glance at debt consolidation choices, search for particular financing options that aren’t out there for civilians. Your historical past of serving our country provides you entry to low-interest charges and optimum mortgage terms to help you regain management over your financial state of affairs. Accessing personal loans for veterans doesn’t mean that you’re receiving cash from the army. Instead, personal lenders provide financing options with competitive fee terms and interest rates. Special issues are provided to veterans and active-duty members. Lenders are willing to supply these monetary options for the explanation that loans may be partially backed by the Department of Veteran Affairs.

Rates vary from 1.25% to 3.3%, relying on factors just like the down cost dimension and your mortgage history. The payment doesn’t apply to military members with service-connected disabilities. Military personnel get certain breaks in the mortgage process, however there is no free lunch. Since the cash grows at 10% and rates of interest on money owed is 6%, you want to dump all you possibly can into an SDP. Military members on Extended Active Duty can organize to have funds mechanically taken from their pay and sent to designated folks or businesses.

No comments:

Post a Comment